finance lease interest in suspense

Effective interest method. Interest expense on lease liabilities 189 - Interest expense on bank loans 74 96 263 96 THE GROUP The increase in finance costs was mainly attributable to recognition of lease liabilities following the adoption of SFRSI 16 Leases.

A Lesson On Leases The Association Of Corporate Treasurers

The leasing company is known as the lessor and the user is known as the lessee.

. The businesss 50 day moving average is 3587. The finance lease accounting journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of finance or capital leases. Should we use same method for actuarial method or can we just record like Debit asset AC 500000.

Interest in suspense is the interest due on non-performing assets held in. A suspense entry will be a debit or credit on your trial balance so its treatment on a balance sheet would depend if it was a debit or credit. The ongoing amortization of the right-of-use asset.

Deferred interest is interest not due at a particular date but which will be due later. The life of the lease is 8 years and the economic life of the asset is 8. Lease liability present value of future lease payments the monthlyquarterlyyearly lease payments plus the expected end payment if any discounted at the interest rate implicit in the lease.

Suspense accounts are routinely cleared out once the nature. When a lessee has designated a lease as a finance lease it should recognize the following over the term of the lease. Identify the type of lease.

The interest rate implicit in the lease is the rate of interest that causes the present value of a the lease payments and b the unguaranteed residual value to. The company has a quick ratio of 133 a current ratio of 196 and a debt-to-equity ratio of 489. Define Finance Lease Obligations.

This means that the interest is due to the company and that the company is entitled to the interest. HP Interest in Suspense. Assuming the monthly repayment is 63500 of which 28900 is the HP interest and HP Principal repayment is 34600.

HOWEVER a suspense entry should never make it as far as your balance sheet. Financial Reporting Matters 1 From 2019 the accounting treatment of leases by lessees will change fundamentally. The ongoing amortization of the interest on the lease liability.

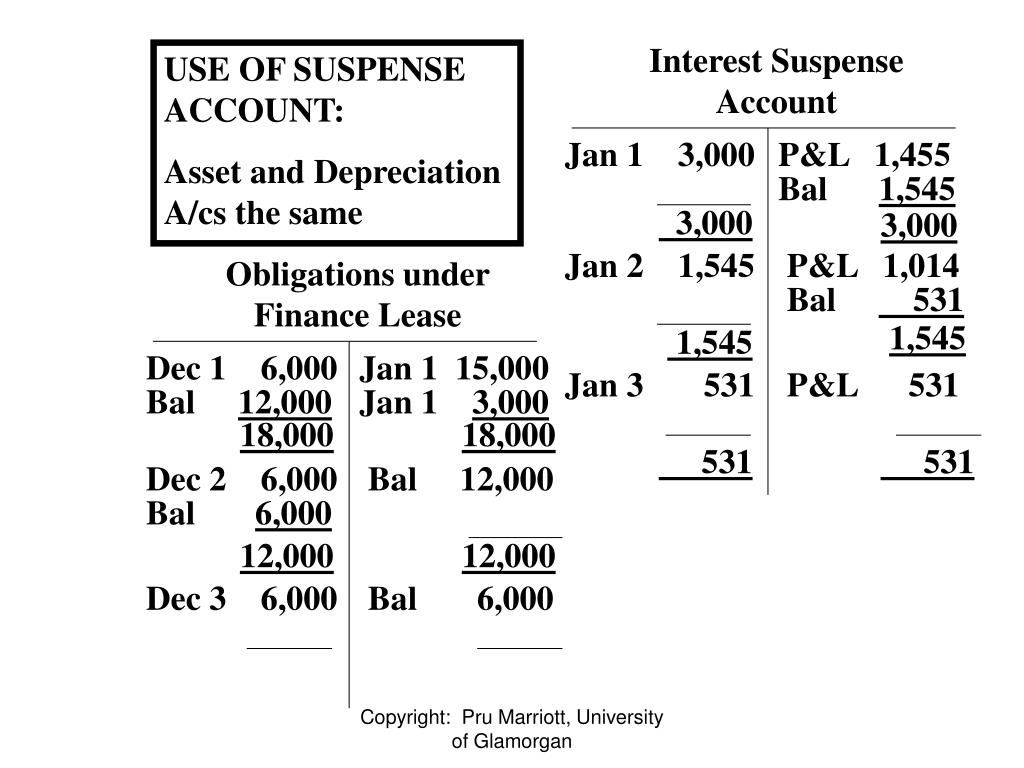

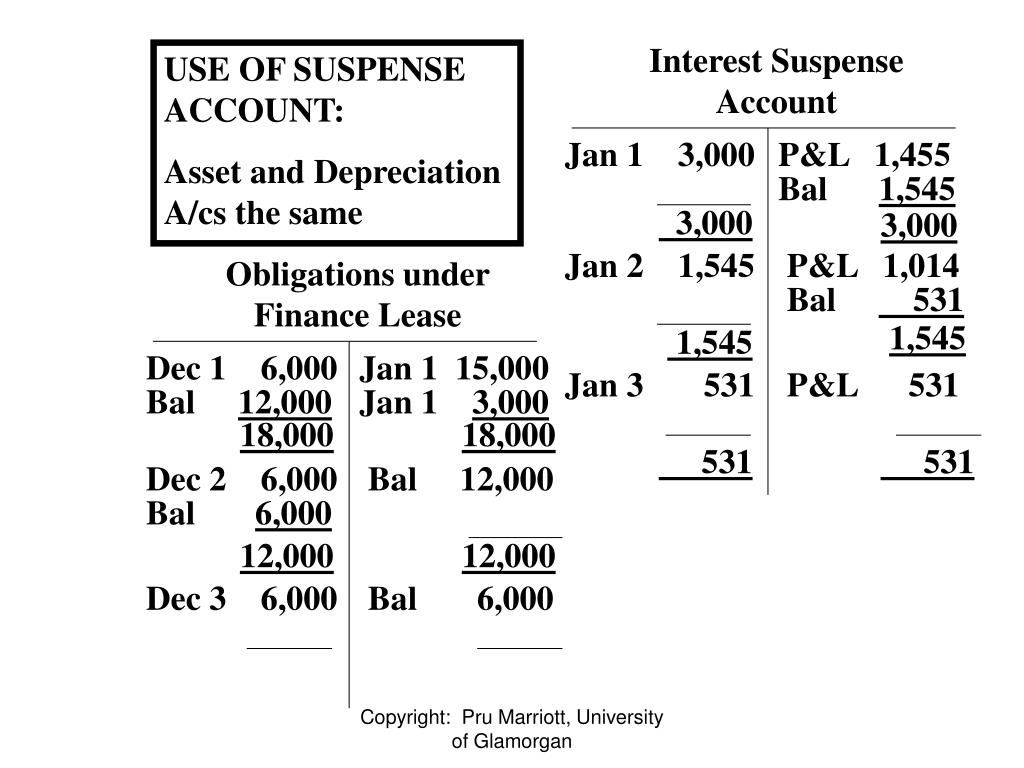

An interest rate of 105 and straight-line depreciation are used. The double entry will be. In the account tab of the Payment transaction.

There is no bargain purchase option because the equipment will revert back to the lessor. In the case of formal agreements such as contracts for asset finance or loans where interest is fixed for the duration the interest is described as being in suspense and disclosed in the balance sheet - First as an asset to be balanced by current liabilities interest payable within 12 months and long term liabilities representing interest payments due after twelve months. Interest in Suspense Interest in suspense appears on a balance sheet when a company has loaned money an asset but the loan has become a nonperforming asset.

The total liability will increase each month by the amount of interest expense accrued until the annual interest payment is. 19 Accounting for Leases. The sum of digits is calculated as 5 512 15 We then calculate the total amount of interest payable over the term of the lease agreement and allocate it as follows.

What is the use of suspense. FRS 116 Leases new standard or FRS 116 eliminates the current dual accounting model for lessees which distinguishes between on-balance sheet finance leases and off-balance sheet operating leases. A suspense account is a catch-all section of a general ledger used by companies to record ambiguous entries that require clarification.

Where the calculation of the interest expense in a finance lease is concerned many practitioners have previously used either the level spread method of interest recognition or the sum-of-the-digits method and concerns have been raised as to how the effective interest method works under FRS 102 because for many this is a new. At the time of the lease agreement the equipment has a fair value of 166000. Interest income is income accrued over the periods of loans advances credit facilities and other types of financial accommodation.

The payment will reduce cash from company and lease liability. Accounting for a Finance Lease. It is a feeling of anticipation that something risky or dangerous is about to happen.

Finance lease simply means a method of providing finance where the leasing company buys the asset for the user and rents it to him for an agreed period. An example of this is if 5 annual payments are required under a finance lease. Debit Hire Purchase Creditor account Balance Sheet.

In each case the finance lease accounting journal entries show the debit and credit account together with a brief narrative. Suspense is a literary device that authors use to keep their readers interest alive throughout the work. You should investigate and correct the suspense entry to what it should be.

Debit -Asset AC 500000 Debit -Interest in suspense AC 100000 Credit -Lease creditor AC 600000. The amount of interest expense for the first month of the lease is 1616 387793 x 5 x 112 and the entry to accrue is below. As to any Person the obligations of such Person to pay rent or other amounts under any lease of or other arrangement conveying the right to use real or personal property or a combination thereof which obligations are required to be classified and accounted for as capital leases on a balance sheet of such Person under GAAP and for the.

And then monthly or yearly interest will charged to PL like Debit PL Lease Interest Credit Interest in suspense AC. Payment Fraction 515 415 315 215 115 Leaserental payments Rental in arrears. A finance lease also called capital lease substantially transfers all the risks and.

40 minutes agoWillis Lease Finance has a 1 year low of 3171 and a 1 year high of 4778. Any variable lease payments that are not included in the lease liability.

Ebook Hmo Property Success The Proven Strategy For Financial Freedom Through Multi Let Property Inv Investing Success Strategies Financial Freedom

New Lease Accounting Standards For Lessees Asc Topic 842 Ifrs 16 Gaap Dynamics

What Is A Suspense Account Example Of Suspense Account Accounting Accounting Books Suspense

Suspense Accounts Explained Youtube

Ppt Topic 3 Powerpoint Presentation Free Download Id 184507

Structured Finance Products Lease Bank Instruments Structured Finance Finance Investing

Finance Lease Accounting Journal Entries Double Entry Bookkeeping

O Rientation Objective Scope Definition Classification Of Leases Finance Lease Operating Lease Finance Leases And Operating Leases Calculations Sale Ppt Download

0 Response to "finance lease interest in suspense"

Post a Comment